Tether poached two senior executives from a bank that oversees one of the world’s most extensive gold vaults.

Summary

- Tether is doubling down on its gold bet by hiring two of HSBC’s top gold traders

- HSBC operates one of the largest private gold vaults in the world

- The stablecoin issuer currently holds more than $12 billion in physical gold

As macro uncertainty fuels renewed interest in precious metals, the world’s largest stablecoin issuer is doubling down on its gold bet. On Tuesday, November 11, Tether announced the hiring of two top gold traders from London-based HSBC.

HSBC’s global head of metals trading, Vincent Domien, will join Tether in the coming months. He’ll be accompanied by Mathew O’Neill, HSBC’s head of precious metals for Europe, the Middle East, and Africa.

The two executives’ role will be to aggressively expand the firm’s physical bullion holdings, which currently total $12 billion.

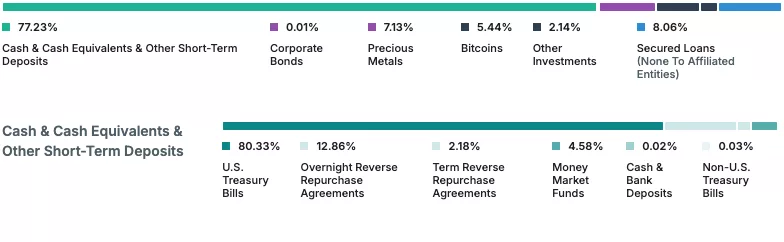

These include the reserves for the Tether Gold (XAUT) token, which has a market cap of $1.56 billion. The remaining physical gold is part of the reserves that back USDT.

Tether plans major gold expansion

Tether has been adding gold to its reserves at an average pace of 1 metric ton per week during September of this year. According to Bloomberg, this makes Tether one of the largest non-state buyers of gold. For this reason, taping HBSC executives makes strategic sense for the firm.

HBSC operates a vast gold reserve in London, one of the largest in the world. The company is also one of the biggest market makers in spot gold, gold futures, swaps, and options. It is also one of the core clearing members in the London Bullion Market Association. HSBC was also one of the first companies to launch a tokenized gold offering, which went live in 2024.