Grayscale Investments has officially launched its Solana ETF, joining Bitwise after its successful debut yesterday. The new fund has now begun trading on the NYSE Arca platform.

Grayscale’s Solana ETF Debuts on NYSE Arca

In a recent press release, Grayscale announced that the Solana ETF is now live on NYSE Arca. This makes it the firm’s first staking-enabled exchange-traded product (ETP) to uplist under the SEC’s updated listing standards. GSOL will offer investors price exposure to Solana (SOL) while integrating on-chain staking yields directly into the fund’s net asset value (NAV).

Introducing Grayscale Solana Trust ETF (Ticker: $GSOL), offering investors exposure to @Solana $SOL, one of the fastest-growing digital assets. $GSOL features:

⚡ Convenient Solana exposure paired with staking benefits.

🔑 Exposure to a high-speed, low-cost blockchain.… pic.twitter.com/TgVNlhqBPO— Grayscale (@Grayscale) October 29, 2025

In contrast to conventional ETFs, GSOL is set up as a trust. This indicates that the fund is subject to greater investment risks, such as the possibility of capital loss, and operates outside of mutual fund regulations.

However, the asset manager emphasized that the ETF’s institutional framework and secure custody solutions are designed to bridge traditional finance with the crypto ecosystem.

“Bitcoin and Ethereum ETPs were just the beginning,” said Inkoo Kang, Grayscale’s Senior Vice President for ETFs. “With GSOL, we’re broadening investor choice by delivering exposure to Solana’s expanding ecosystem, combining growth potential, staking rewards, and institutional-grade safeguards.”

Kristin Smith, President of the Solana Policy Institute, hailed the listing as a turning point.

“The rails of global finance are being rebuilt on Solana, and this Solana ETF gives millions of investors a regulated way to participate, and even help secure the network through staking.”

The firm’s move comes just a day after Bitwise Asset Management launched its Bitwise Solana Staking ETF (BSOL). The product saw one of the biggest crypto ETF debuts since Ethereum products hit the market earlier this year.

According to an SEC filing earlier this month, Grayscale set a 0.35% management fee for the Solana ETF, payable in SOL. The firm noted that the structure aims to balance competitive costs with stakeholder-based value accrual.

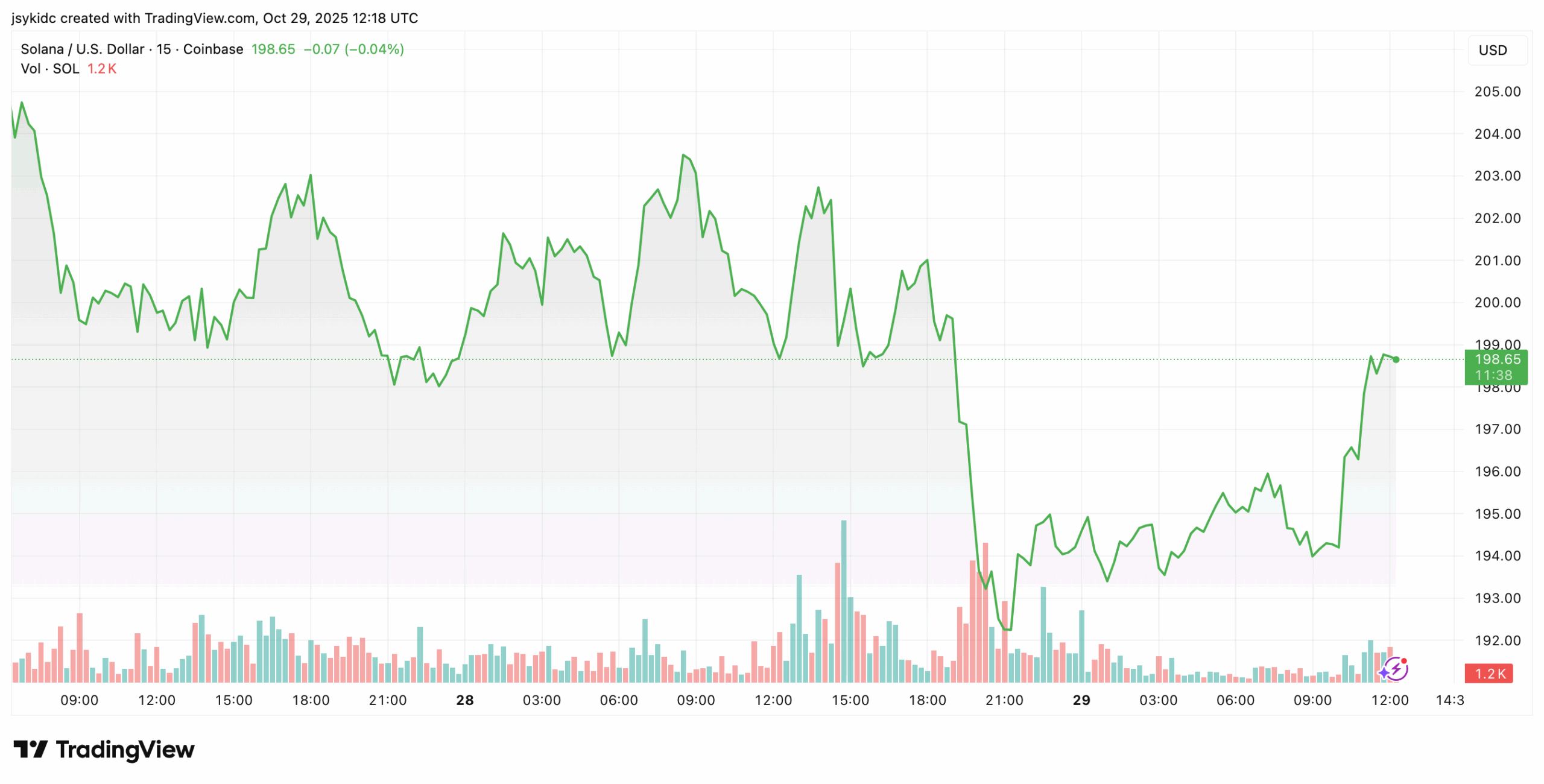

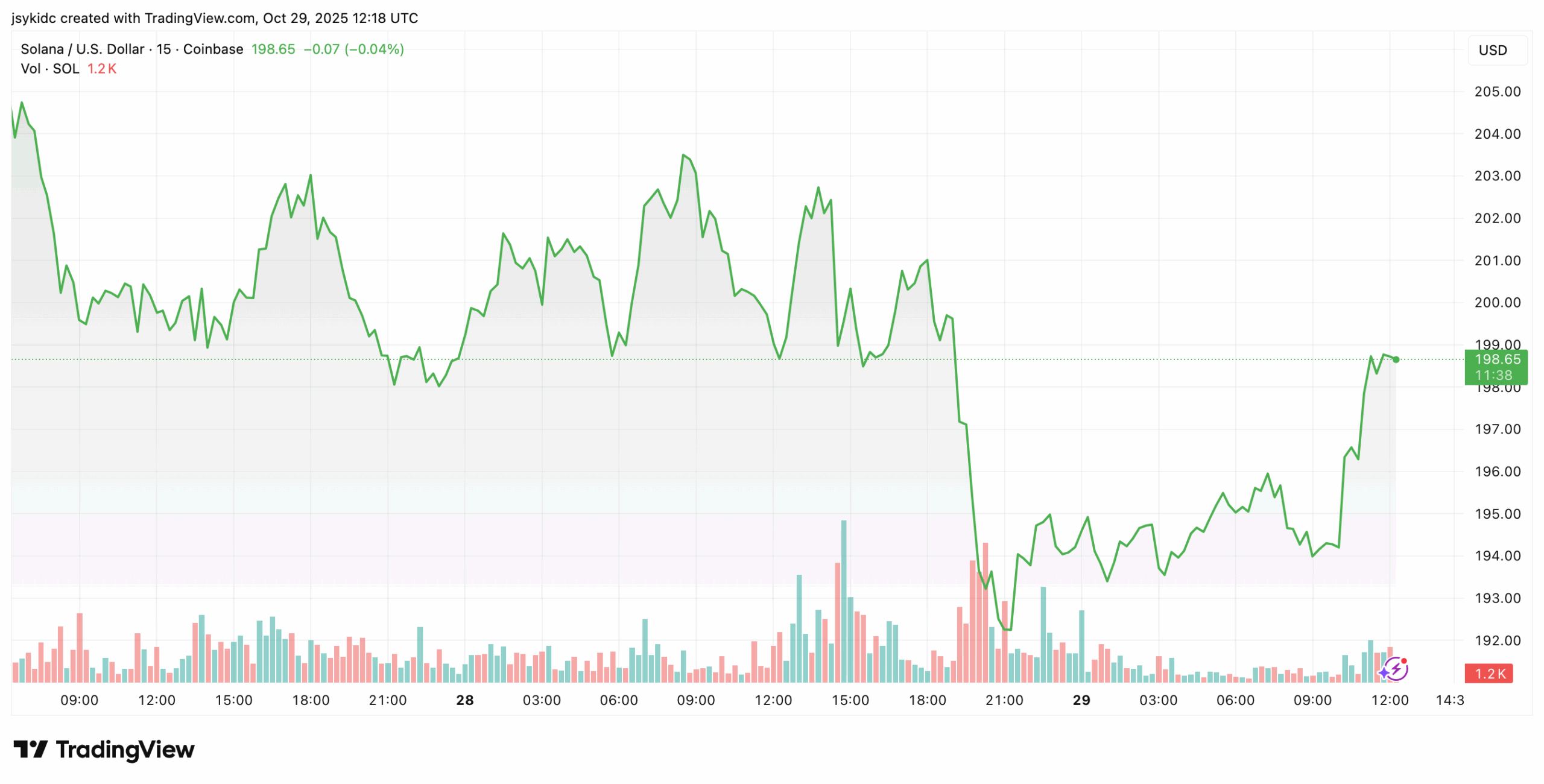

Solana Price Stalls Despite Bullish Fundamentals

Despite this momentum, the Solana price dipped slightly by nearly 1% to $198.73. This is primarily due to broader weakness in the crypto market ahead of the U.S. Federal Reserve’s October rate decision. However, data also showed SOL’s trading volume surged 23% over 24 hours.

Beyond ETF launches, Solana’s momentum continues across multiple fronts. Western Union announced plans to issue a U.S. dollar-backed stablecoin, the USD Payment Token (USDPT), built entirely on the Solana blockchain.

Meanwhile, on-chain analyst DeFi Tracer has flagged a notable whale activity. He shared that a trader had opened a $74.3 million long position in SOL.