According to market commentators, a sharp split has opened between backers of Bitcoin and supporters of precious metals after a year of big moves in both camps. Bitcoin’s long-run gains are being held up as proof it remains the top performing asset, while gold and silver have staged a dramatic rally that has surprised some investors. Opinions are divided and the debate is loud.

Related Reading

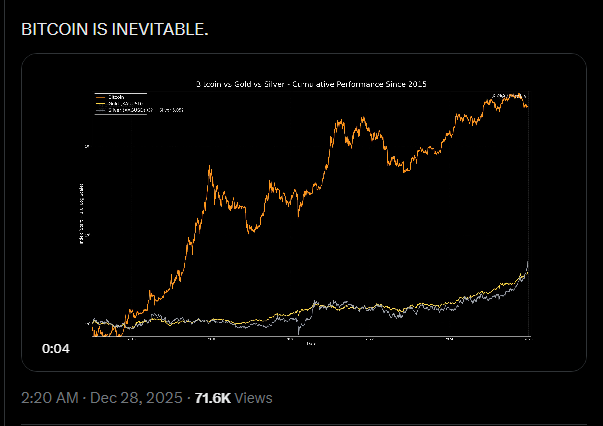

Bitcoin’s Big Lead Since 2015

Bitcoin has climbed about 27,700% since 2015, a figure cited by analyst Adam Livingston. That figure dwarfs the gains recorded for silver and gold over the same stretch, which are roughly 400% and 280% respectively.

Livingston argued that even if you ignore Bitcoin’s earliest years, the cryptocurrency still outpaced the metals by a large margin. Some see that as a clear win for the crypto thesis. Others are not convinced.

Bitcoin vs. Silver vs. Gold since January 1st, 2015:

Silver: 405%

Gold: 283%

Bitcoin: 27,701%Even ignoring the first 6 years of Bitcoin’s existence for the crybabies who whine about the timeframe comparison…

…gold and silver drastically underperform the APEX ASSET.… pic.twitter.com/vdAnatqRKG

— Adam Livingston (@AdamBLiv) December 27, 2025

Critics Push Back On Timeframes

Gold advocate Peter Schiff told Livingston to focus on a shorter span — the last four years — and said Bitcoin’s moment may have passed. That challenge reflects a wider worry among metal holders that past performance may not repeat.

Now do the last four years only. Times have changed. Bitcoin’s time has passed.

— Peter Schiff (@PeterSchiff) December 27, 2025

Orange Horizon Wealth co-founder Matt Golliher offered a different angle, saying commodity prices tend to move back toward the cost of making them, and that higher prices often trigger more supply. He also pointed out that sources of gold and silver that were not profitable a year ago are now being mined at a profit.

Supply And Macro Forces Driving Prices

Gold and silver both surged to new highs in 2025. Reports show gold reached about $4,533 per ounce and silver approached nearly $80 per ounce. At the same time, the US dollar has weakened, with the US Dollar Index down roughly 10% for the year.

Several analysts linked those moves to expectations around Fed easing in 2026 and to growing geopolitical tensions that can push traders into scarce assets. Zaner Metals strategist Peter Grant said thinner trading and the Fed outlook helped fuel sharp swings.

Surprisingly unpopular opinion: Gold and silver do not need to slow down for Bitcoin to do well.

Bitcoiners thinking that needs to happen, are low T, and don’t understand any of these assets.

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) December 28, 2025

Related Reading

Bitcoin’s Path Is Not Tied To Metals

According to analysts from Glassnode and macro strategists, Bitcoin does not need gold or silver to cool off before it can rise again.

James Check, a lead analyst at Glassnode, argued that the assets do not have to trade against one another. Macro strategist Lyn Alden echoed that view, noting the two can both attract demand at the same time and are not strict rivals in practice.

Arthur Hayes added that Fed easing and a weaker dollar should lift scarce assets broadly, including digital and physical stores of value.

Featured image from Unsplash, chart from TradingView