Solana’s price continues to decline, extending investor losses and reinforcing the ongoing bearish trend across the broader crypto market.

Despite periods of recovery in recent months, the altcoin now faces intensified downward pressure. Its close correlation with Bitcoin may be a key factor driving Solana’s latest capitulation.

Solana Is Depending On Bitcoin

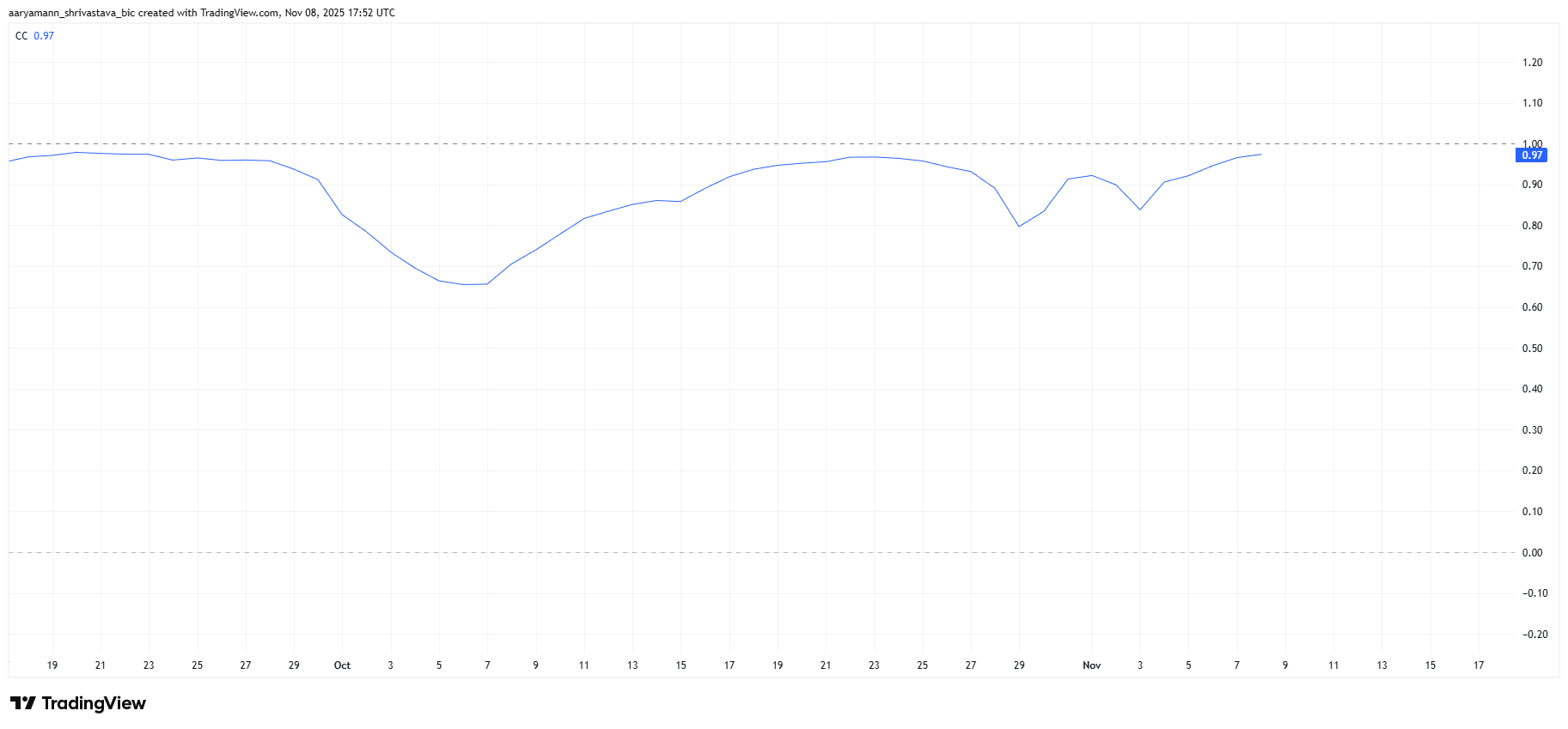

The correlation between Solana and Bitcoin currently sits at an exceptionally high 0.97, indicating that SOL ($157.52)’s price movements closely mirror those of the world’s largest cryptocurrency. This correlation means any weakness in Bitcoin’s market performance directly affects Solana’s trajectory.

With Bitcoin hovering near the $100,000 level and struggling to break higher, Solana’s price faces a continued risk of decline.

The lack of bullish momentum from Bitcoin translates into stagnation for SOL, limiting the token’s potential for independent growth and raising concerns about its near-term stability.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana Correlation To Bitcoin. Source: TradingView

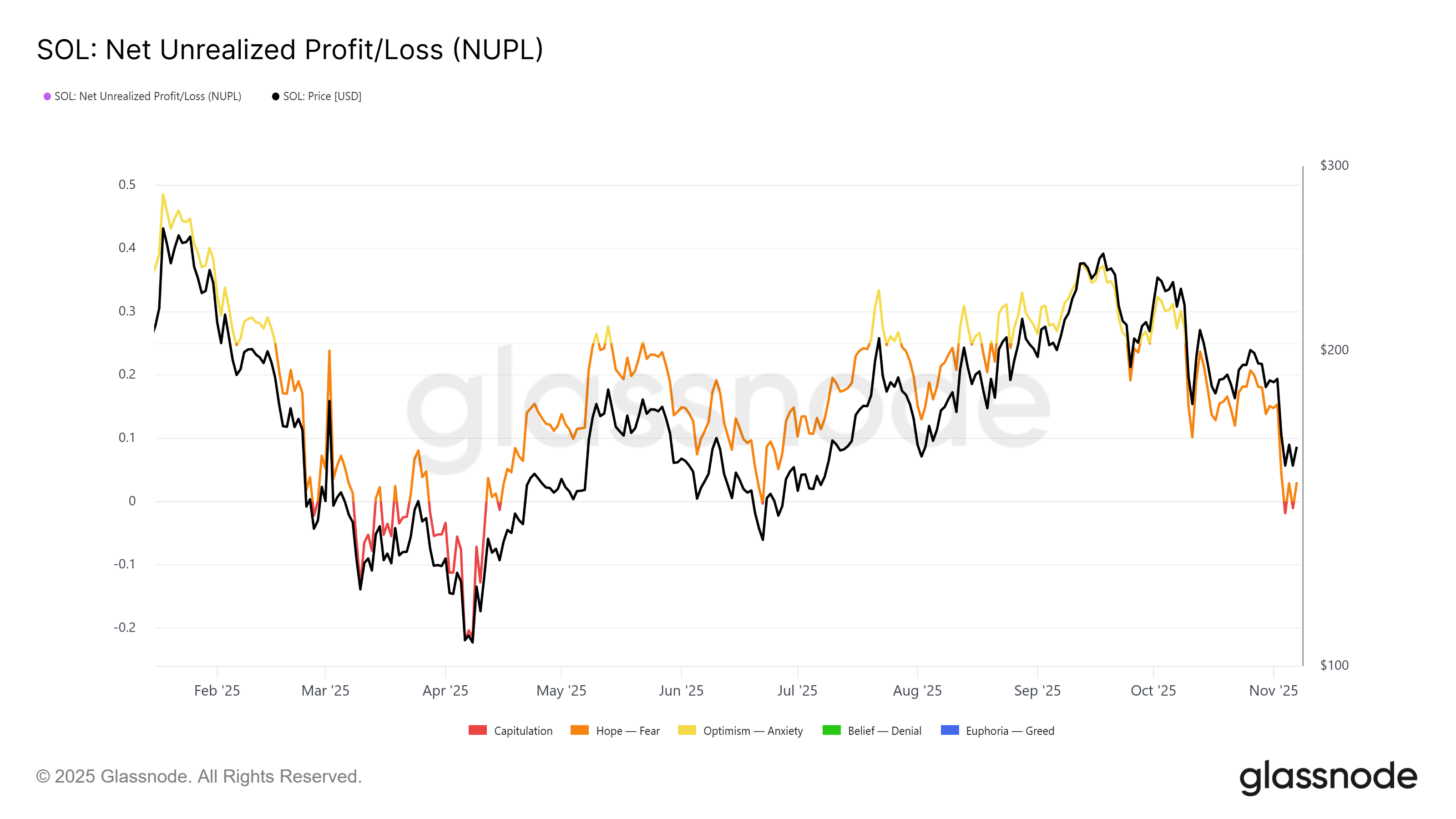

Solana Correlation To Bitcoin. Source: TradingViewFrom a macro perspective, Solana’s Net Unrealized Profit and Loss (NUPL) metric has entered the capitulation zone, signaling investor caution.

Historically, dips into this zone have marked critical turning points for Solana, as investors often hold rather than sell at a loss, slowing further downside.

Currently, Solana’s NUPL is hovering just inside the capitulation range. However, given its strong correlation to Bitcoin, the metric could deepen if BTC ($102,038.00)’s weakness persists.

Ironically, this dip could create the conditions for a rebound, as capitulation phases have historically preceded accumulation and recovery for SOL.

Solana NUPL. Source: Glassnode

Solana NUPL. Source: GlassnodeSOL Price Could Bounce Back

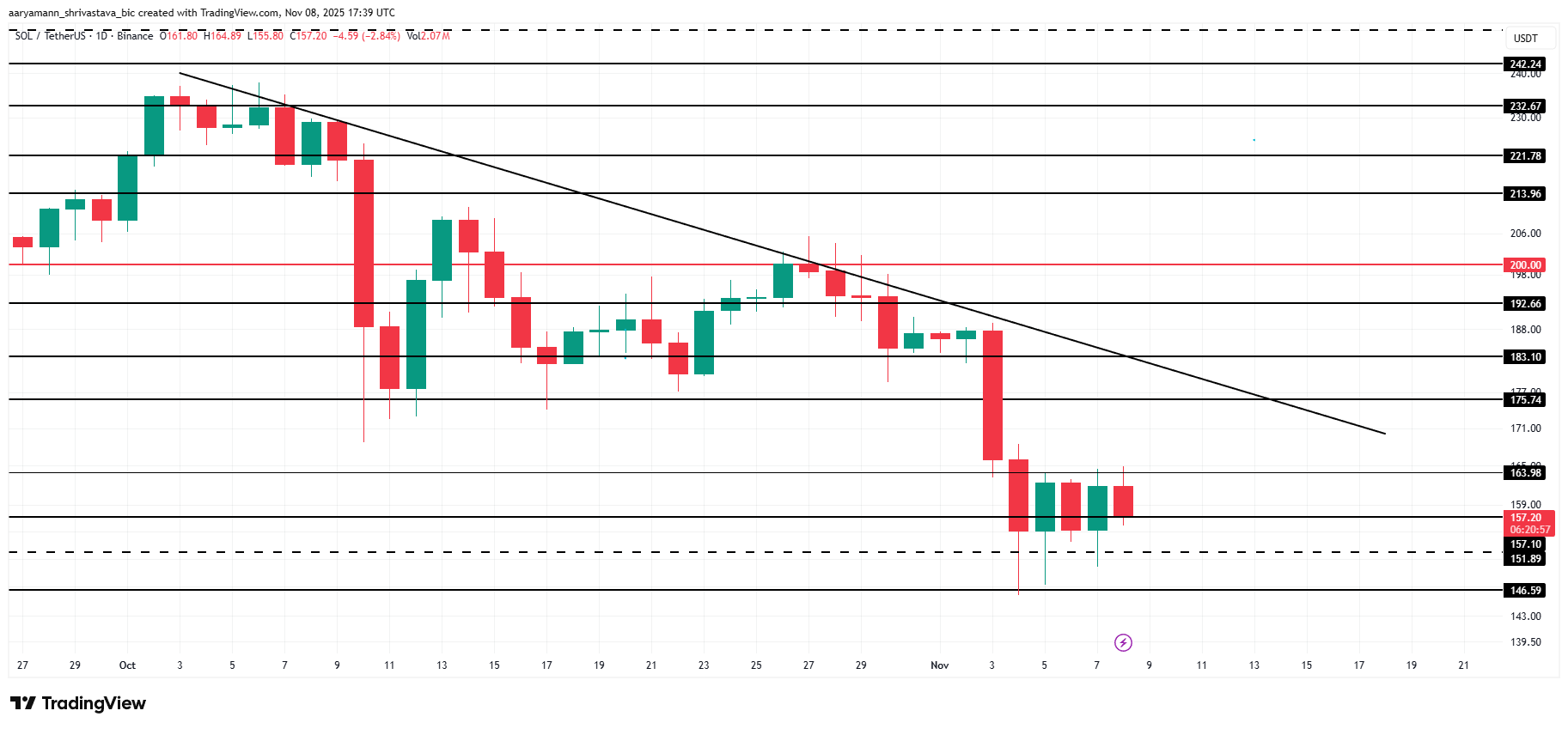

At the time of writing, Solana trades at $157, extending a month-long downtrend. The token’s performance remains tethered to Bitcoin’s movements, making further declines likely if BTC fails to stabilize.

In the short term, Solana could face additional bearish pressure, sliding to $150 or even $146. Such a drop may spark renewed buying interest, helping SOL recover toward $163 and potentially $175 as confidence returns.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingViewHowever, if Bitcoin’s price continues to deteriorate, Solana’s downtrend may intensify. A break below $146 could push the token toward $140, deepening investor losses and invalidating any bullish recovery thesis for the near future.

The post Solana’s Connection To Bitcoin Has Led To Price Capitulation appeared first on BeInCrypto.